3 reasons why you should think twice before canceling your auto insurance on a stored vehicle.

September 17, 2019

Before you renovate, check your insurance coverage.

November 29, 2019The provincial landscape for auto insurance in recent years has been complicated to say the least. First, the NDP government put a 5% rate cap on increases to auto insurance – and that rate cap made it almost impossible for insurers to stay in business in Alberta. Then, in August of 2019, the UCP government removed the rate cap in order to make it more feasible for insurers to stay in province. But with no rate cap, comes rate increases.

But my auto insurance rates already went up a bit…could they go up more?

Sadly, yes. Even with the rate cap in place, some people saw rate increases. Now with the rate cap removed, all insurers are going to be issuing increases to most customers in an attempt to get back to where the rates should’ve been had the cap never been in place.

5 reasons why auto insurance premiums are increasing

- The costs of vehicle repairs and medical services have gone up exponentially.

- There are more Albertans claiming for serious injuries in vehicle accidents.

- There are more weather related claims.

- There has been an increase in fraudulent claims.

- Alberta leads the country in vehicle theft.

Premiums of the many pay the claims of the few.

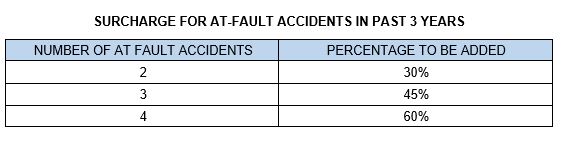

The auto insurance industry has been set up based on this very simple premise. We all contribute premiums to cover the cost of those who make claims. More claims or higher claims means that everyone must carry this burden. This allows everyone access to insurance and driving. But that’s not to say that there aren’t penalties in place to deter bad driving. There are – in the form of surcharges. Here is an example of the penalties taken from the Alberta GRID Cheat Sheet published by the Automobile Insurance Rate Board.

What’s an Albertan driver to do?

The best way to make sure you’re getting the right coverage at the best price is to talk to a professional insurance broker. The more your broker knows about you, your vehicle, your driving history etc., the better they can find you auto insurance options that meet your needs.

A good insurance broker can find out what discounts you could qualify for – loyalty discounts, multi-line discounts and affiliation discounts change from provider to provider. A broker will also take the time with you to review your current coverage needs and make recommendations. For example, if you drive an older vehicle, it might not be worth carrying collision on your policy.

It’s important to know that shopping around for a new auto insurance options is best done within 30 days of your current policy renewal. So as your vehicles come up for renewal and you know the extent of your premium increase, reach out to a professional insurance broker to see if you can find a way to minimize your increase while maintaining the right coverage for your situation.

Are you already 30 days from renewal? Get an auto insurance quote now!